April, 2025

Lasenor specializes in the production and development of Lecithin and is actively present in the main sourcing regions for Non-Genetically Modified origin. We will offer regular insight on its market development as a diagnostic tool.

In the Q3 2024 edition, we highlighted a mismatch between Non GMO lecithin prices and prospective supply outlook. In our views, the bullish impact of deteriorated crops was undervalued and we predicted less Non GMO lecithin availability in the coming months, leading to a moderate upward pricing.

This prediction is now materializing.

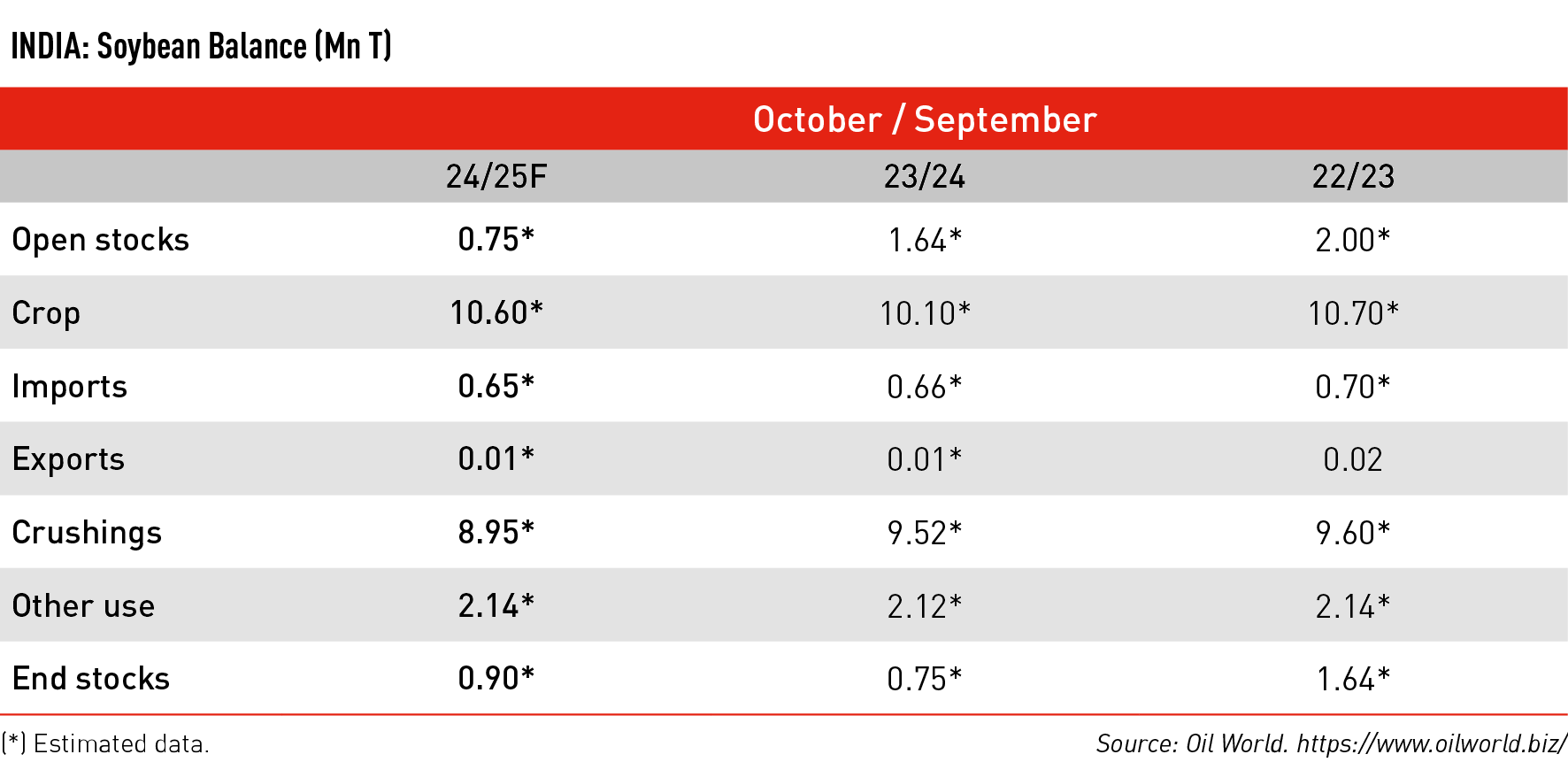

Due to a lack of competitiveness in the oil and meal markets, soyabean crushing declined dramatically in India during the period Oct 2024- Jan 2025.

On top of that, the feed industry has switched approx. 50% of the soya meal consumption to more affordable dried distillers grain solids (DDGS) from corn which protein content is 38-40%.

January estimation for yearly decline in soyabean processing in India is approx. 0.5 – 0.6 MnT in Oct 2024 – Sept 2025.

There is no doubt that this decline in soya bean processing will have an impact on lecithin production, even more considering the poor quality of the beans due to excessive moisture. Current loss estimation on lecithin production is sized at approx. 3500-4000 T.

In this configuration, prices are rising by approx. 15-20% v/s Q4 2024.

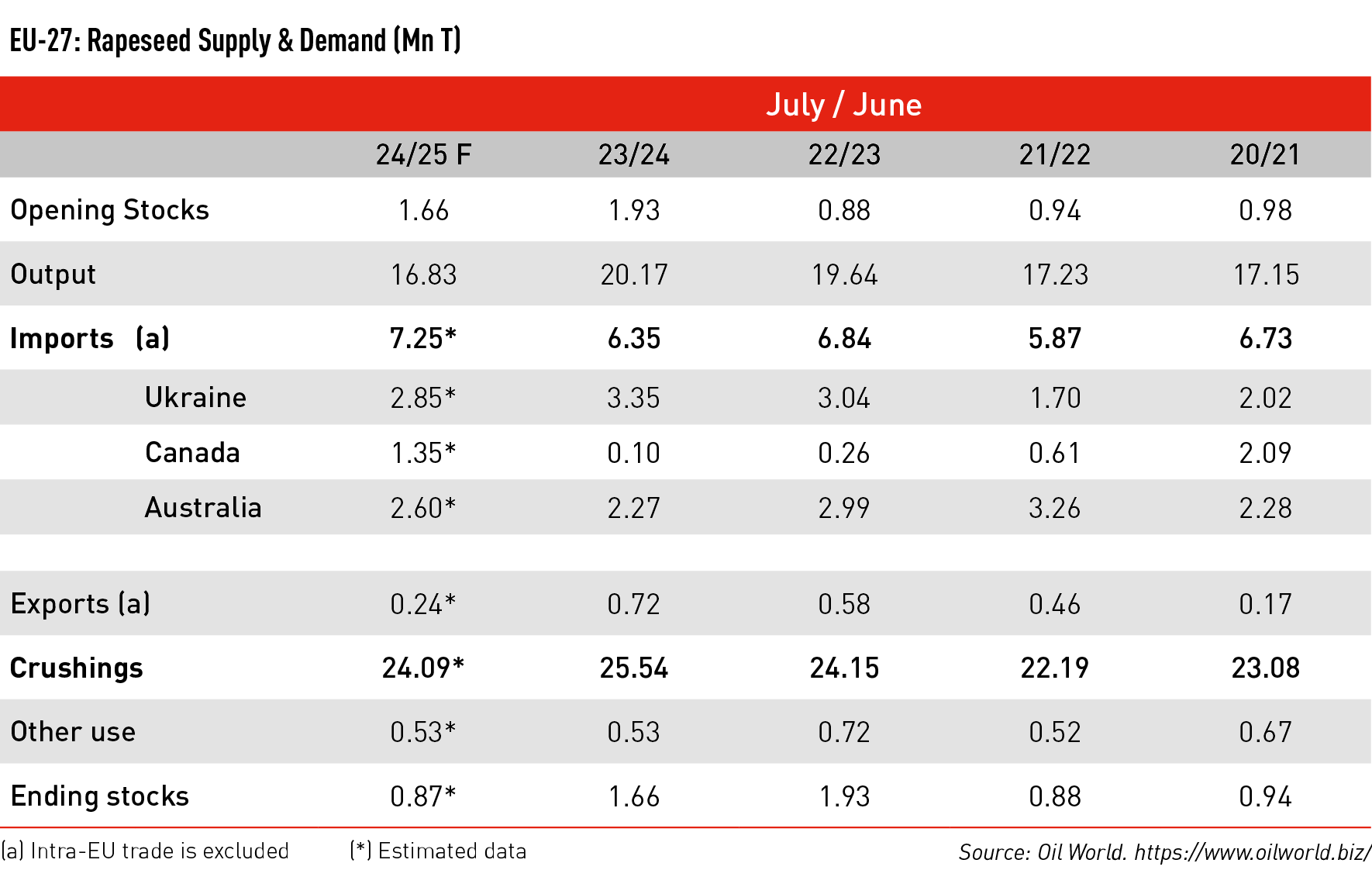

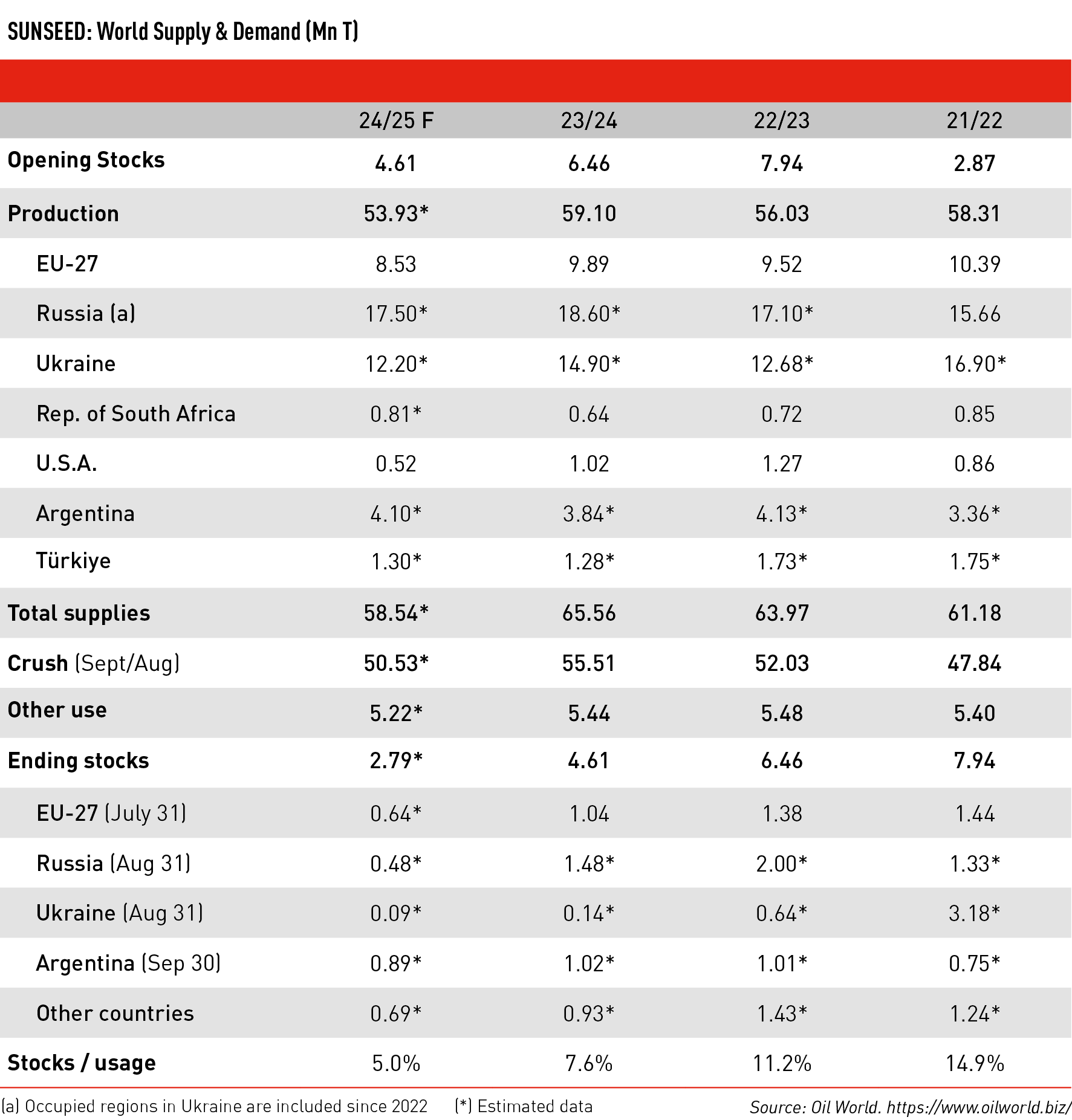

World production of sunflower and rapeseed has decreased by a combined 10.5 MnT in 2024. The biggest losses occurred in EU, Ukraine, Russia, Canada, India and Australia. Last year EU rapeseed crop was 16.8 MnT v/s 20.2 MnT in 2023.

Due to the smaller crop in the Black Sea, EU crushers will have lower imports from Ukraine (around 0.3 Mt compared to 1.4 MnT a year earlier), which will force them to purchase seeds in Australia and Canada at a higher price.

Rapeseed crushings are expected to be down 1.45 Mn T in Jan-Jun 2025.

Regarding sunflower, crushers are facing 3 major challenges:

2024 updated crops estimates are:

In such a configuration, Jan/Aug 2025 loss in crushing is sized at 5 MnT.

The market for non-GMO lecithin remained under pressure during the last quarter of 2024 and the first two months of 2025, while the vegetable oil market almost instantly passed on the poor harvest forecasts for 2024.

This inertia, due to the small size of the lecithin market, is ending because of the decline in crushing both in India and in Europe. Lecithin availability is likely to be limited in the coming months, and joining with new harvests will be difficult. Especially since the upcoming harvests in South America are not as good as originally forecast.

At Lasenor, we remain dedicated to monitoring market dynamics, providing timely insights, and offering comprehensive support to empower informed decision-making. We invite you to partner with us and unlock the true potential of your products in this evolving market. For any additional information or inquiries, please feel free to contact us.

Article Sourced from Lasenor